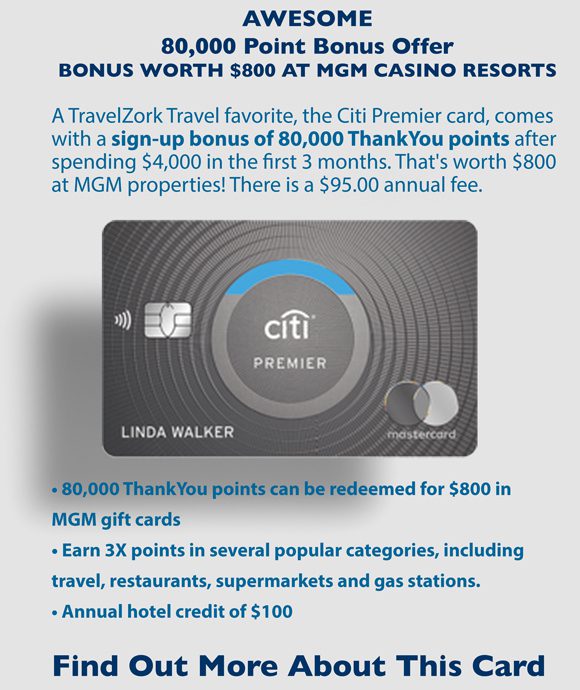

Snag Your 80,000 Citi ThankYou Points Bonus

The Citi Premier Mastercard (They’re too cool to use the whole “Citibank” name.) is not only one of the best cards for everyday spending but is also offering a limited-time premium sign-up bonus: 80,000 Citi ThankYou Rewards Points, worth at least $800 in cash (Seriously, they’ll send you a check if you don’t like any other rewards.). In other words, you will do no worse than getting a penny per point.

The card has offered a promotional 80,000-point sign-up bonus for a few months now, and I figure that it can’t last forever. Grab it while you can.

Affiliate Disclosure: To answer your first question, yes, some of these links do pay us referral fees. But please keep two things in mind: First, we will never post a card simply because of the opportunity to earn money. In fact, we own most of the cards personally that show up on the “our favorite cards” page. And second, if we see a better offer for the same card that we can give you, we will direct you to it. We promise. The content on this page is all ours. The companies that we discuss do not review or endorse it. All opinions are ours. You can’t have them. Please view our advertising disclosure page for additional details about our partners.

Why the Citi Premier Card is Worth Having

Forget the $800 that you get for signing up for the card and meeting the minimum spend ($4,000 total, not per month, in the first three months). This is a card that you’ll actually want to keep. For starters, it will give you 3 points per dollar spent in the following categories:

- Supermarkets

- Airfare and Hotels

- Gas Stations

- Dining

- 1 point per dollar spent on anything else

Hotel benefits: You’ll get $100 back on a stay of $500 or more once per year. That $100 will more than cover your $95 annual fee.

Transfer benefits: You can transfer points to any of 14 airline or 2 hotel programs.

Point Value: I value Citi ThankYou Reward points as worth at least 1.5 cents each if you transfer them to one of the airline partners.

How to Travel for Free (to Las Vegas or anywhere else)

Let’s get right to it. Here’s how to take advantage of the 80,000 bonus points from Citi Premier:

Option 1: The Easy Path

Collect your 80,000 points after you meet the minimum spend on the Citi Premier card. Go to the Citibank website and log into your account. Transfer $800 in your bank account. Find a flight on Spirit, Frontier, Southwest or another cheap airline. Find a cheap hotel. Or redeem for $800 worth of MGM gift cards. Or just keep the $800. Remember, this is easy.

Option 2: The Easy Path with an Extra Step or Three

Collect your 80,000 points and open a JetBlue TrueBlue (frequent flyer) account. Don’t worry, it’s free.

- Go to JetBlue’s website, enter your dates and cities, and check the box that says “Use TrueBlue points.” It will tell you how many points your flight costs. You can do that without a JetBlue account.

- Transfer the number of points you need to JetBlue from your 80,000 points. They transfer 1-for-1 and you can do it online.

- Buy your ticket on JetBlue, once again checking the box that says “Use TrueBlue points.” Prepare to fly!

Your flight will likely not cost the full 80,000 points. For instance, I saw round-trip flights from New York to Las Vegas for about 35,000 points and from Los Angeles for about 9,000. Your mileage may vary, but probably not by much.

Flight Example:

You can then take your leftover points and do whatever you’d like with them. Cash them out, pay for somebody else’s ticket or whatever else you can think of.

Option 3: Fly Somewhere Else

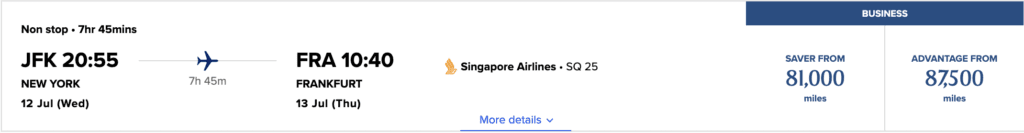

You can also transfer your points to one of 13 other global partners. Not sure what that will get you? How about a one-way business class ticket to Europe on one of any number of carriers, including Singapore or Turkish?

Flight Example:

Airline partners include:

- Aeromexico

- Cathay’s Asia Miles

- Avianca LifeMiles

- Emirates Skywards

- Etihad Guest

- Eva Air

- Flying Blue (Air France/KLM)

- Qantas Frequent Flyer

- Qatar Privilege Club

- Singapore Airlines Krisflyer

- Thai Royal Orchid

- Turkish Airlines Miles & Smiles

- Virgin Atlantic Flying Club

And that’s all. You can keep the card for a year and if you like it (I like it personally and have one.), renew it. If not, cancel it (The easiest way to do it is usually to cancel online via chat.). Added bonus: Even if you like the card, call to cancel it after a year and see if they offer you an additional bonus to keep it. That way, you’ll get extra rewards for a card that you never intended to cancel anyway! Worst case scenario, they don’t offer you anything extra and you tell them not to cancel it.

The Bottom Line

The Citi Premier card offers $800 in cash, or more value in travel, just for getting the card and meeting the minimum spend. Don’t plan on spending that much? Think about prepaying insurance, buying restaurant gift cards or supermarket gift cards for your favorite places (Remember, you’ll earn 3 points per dollar that you spend.) or accelerating large purchases.

I think that it’s a good card to keep in your wallet going forward, particularly if you’re going to use the $100 hotel credit. Otherwise, well, you’ll simply be enjoying that free trip.

Michael is a travel enthusiast who is passionate about food and casino adventures and is very detail-oriented when it comes to travel, especially when it comes to the entire flight and airport experience. Before returning to the USA, he resided in Europe (Amsterdam and London) from 2013 to 2020. Current passion projects include TravelZork, the creation of ZorkFest (The Preeminent Consumer-Focused Travel Loyalty (Miles+Points) and Casino Loyalty Conference), and ZorkCast Podcast. In addition, Michael is passionate about the history of Las Vegas and Atlantic City, as well as baccarat, and enjoys cooking and experiencing food around the globe.