Every December, the world is treated to the Delta Analyst Day. Management stuffs a bunch of Wall Street analysts in a windowless room and briefs them on the state of the airline. There’s rarely anything too exciting*, but at least we get an idea of what the airline is thinking about. This year, they’re thinking about how much money they are making.

Delta Analyst Day — They’re Back!

Well, that was fast. The overriding theme of today’s analyst day was simple. After three years of depressed demand from the global health crisis, they’re set up for a fantastic run.

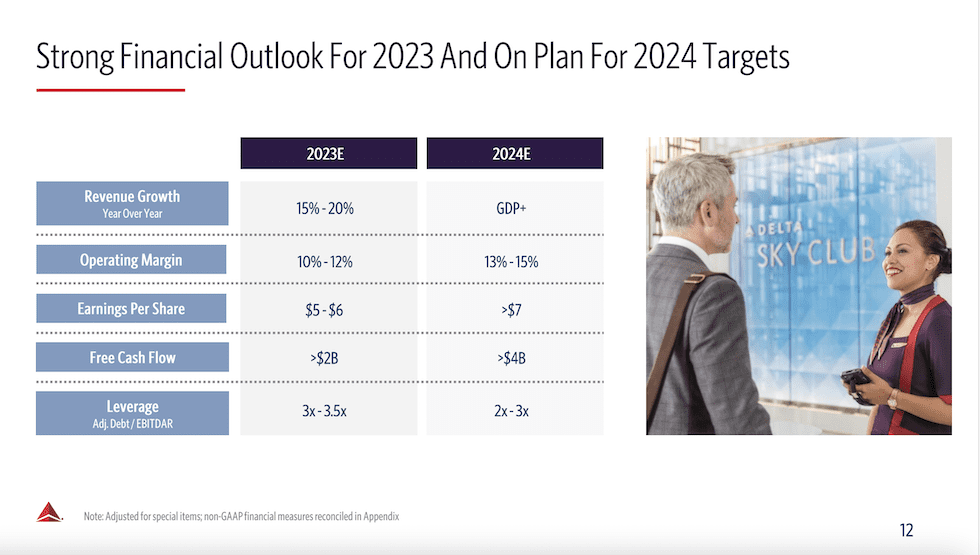

Earnings Could Double in 2023

Delta’s earnings could double in 2023. Photo credit to the analyst deck.

Airline earnings are a delicate beast. Even a small change in revenue or costs could have a massive impact on the final number. But Delta is of the opinion that they are in for a multi-year run. Excess capacity has traditionally been the killer of airline bull markets in the past, but growing won’t be so easy this time around. Thanks in part to 2020 retirements (forced or otherwise), there’s a massive shortage of pilots. Balance sheets around the industry aren’t great. And really, nobody’s in a hurry to do anything. Everyone is doing well. They’ll mess it up eventually, of course. It just might take longer this time.

Finance Geek-Out: Doubling your earnings is a major accomplishment, but it’s easier in the airline industry than others. It has a high fixed-cost but low variable-cost model. Even in a downturn, they still have to pay for their planes, pay to buy planes, pay labor, etc. But if they get more passengers or ticket prices go up, their costs will barely change, outside of a few extra cans of Coke.

Simple example: If Delta has $100 in revenue but $95 in costs, it earns $5. Now, suppose it takes a 5% price increase and there’s no impact on demand (unlikely, but it’s just an example). Their costs won’t go up, so now their profits are $105-95, or $10. The 5% revenue increase doubles their earnings.

Truthfully, a healthy airline industry is good for passengers. Financially flush carriers aren’t forced to add back seats, cut back service, fire customer service reps, etc. We all like to pay lower prices but, as Spirit has shown us, it comes with a cost.

Premium and Non-Ticket Revenue Continues to Grow

A long long time ago, in a galaxy far, far away, the airlines made money by selling tickets. It’s a novel thought, that airline revenue might simply come from selling, well, airline tickets.

Other Ways To Generate Cash

Over time, though, the airlines have realized that there are other ways to generate cash. And there’s nothing wrong with that. The airlines are publicly traded, profit-seeking entities. If they have a way to generate profits, they will do it. Technically, they’re obligated to do it. The moves aren’t always what we’d consider “customer friendly,” but neither is selling an $11 bucket of popcorn at the movies.**

Premium and non-ticket (PANT) revenue has become a particularly important part of the business. Fees are great because they generally aren’t taxed at the same rate as tickets. Upgrades are easy to sell. Given the amount of data that it has, the airline can determine the price at which it can get a passenger to pay for an upgrade from coach to first class. Best case scenario, they make a few bucks on the sale. Worst case? A happy elite member.

Delta isn’t quite at the level of the ultra-low cost carriers, where non-ticket revenue (There’s very little premium.) is core to the product, but they’re happy to take any extra cash that doesn’t have costs associated with it.

Some Great Credit Cards which are TravelZork Favorites

Learn how to apply!

Chase Sapphire Preferred Card

Business Credit Cards

Chase Ink Business Cash

Chase Ink Business Preferred

Business Platinum Card from American Express

(A new 100k bonus offer launched!)

American Express and Delta Are Still Besties

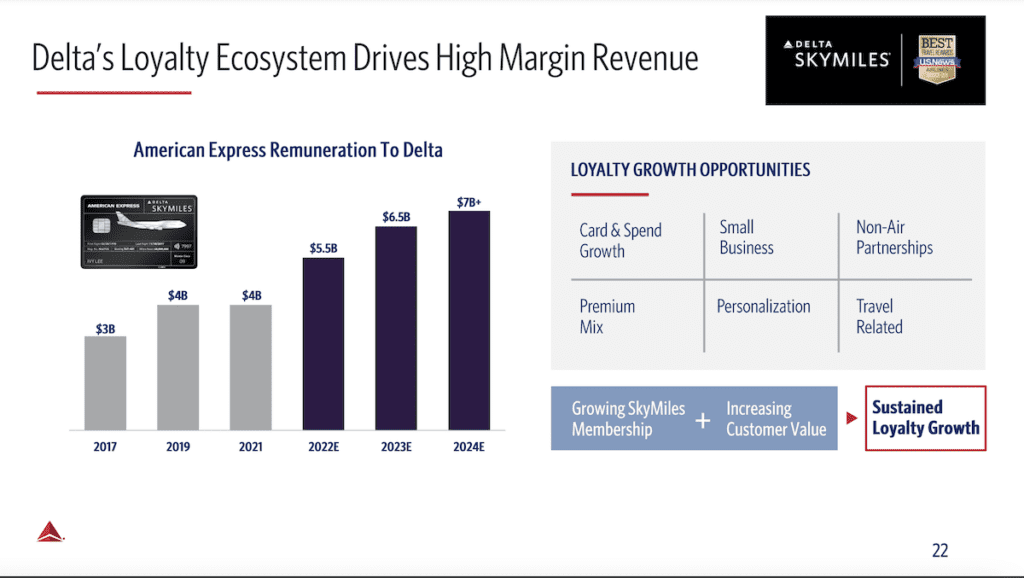

We often hear that airlines are just credit card companies that fly planes. Not totally true, but Delta has billions of reasons to love American Express.

According to management at the Delta Analyst Day, by 2024 they expect to have 7 billion of those reasons. Obviously, it’s sale of miles to American Express, but there are lounge agreements, advertising agreements and, well, just about any other agreement that you can think of. There’s a reason that Delta is going to be cutting single-membership access to Delta elite members but not to American Express Platinum card members.

This partnership is going to deepen. And why shouldn’t Delta continue to sell miles? They sell miles to American Express at a fixed rate. And when you choose to redeem them, Delta can give you whatever value it wants, due to its variable redemption levels. Remember, there’s no award chart anymore, so Delta sets the price based on demand for the flight. Full disclosure: I have a Delta Amex Reserve card. It’s expensive, but I get a ton of value out of it. But the miles are not where I find the value.

Delta’s Near-Term Future Looks Good

Airlines are terrible long-term businesses. They’re capital intensive, labor intensive, tend to carry a lot of debt and are highly cyclical. But the laws of supply and demand are working in Delta’s favor now. Demand is improving, while it’s hard to add capacity. There will come a time when the airlines mess it up or a recession hits them hard. But for now, the runways are covered in cash.

*Sometimes, there is excitement. The best moment occurred several years ago, when a glass fell from the second level and almost hit Wolfe Research analyst Hunter Keay on the head. Coincidentally, Hunter was quite negative on the stock. No charges were ever brought, as Delta management argued (correctly) that Hunter had pissed off so many people around the industry that there was simply no way to determine the culprit.

**Of course, movie theaters are rarely bailed out by the government. The same can’t be said of airlines. It is not unreasonable to argue that the government has bailed out the industry more than once, with minimal long-term benefit to passengers (other than being able to fly, of course). There are absolutely some legitimate complaints here. But that’s for another post.

Michael is a travel enthusiast who is passionate about food and casino adventures and is very detail-oriented when it comes to travel, especially when it comes to the entire flight and airport experience. Before returning to the USA, he resided in Europe (Amsterdam and London) from 2013 to 2020. Current passion projects include TravelZork, the creation of ZorkFest (The Preeminent Consumer-Focused Travel Loyalty (Miles+Points) and Casino Loyalty Conference), and ZorkCast Podcast. In addition, Michael is passionate about the history of Las Vegas and Atlantic City, as well as baccarat, and enjoys cooking and experiencing food around the globe.