Las Vegas tourism hit a speed bump this summer, with official reports showing a noticeable drop in visitor numbers, hotel occupancy, and overall spending. While travelers across the U.S. and Europe kept moving, Sin City’s summer performance fell short—here’s why.

Why Las Vegas Tourism Dropped in Summer 2025

According to the June 2025 Las Vegas Convention and Visitors Authority (LVCVA) Executive Summary, visitor volume fell 11.3% year over year to around 3.1 million. Hotel occupancy dropped 6.5 percentage points to 78.7%, the average daily rate (ADR) slid 6.6% to $164, and revenue per available room (RevPAR) tumbled 13.8%. Air passenger volume through Harry Reid International also dipped 6.3%. Several factors hit Las Vegas tourism hard: weaker consumer confidence as budget-conscious travelers shortened trips or reduced spending, convention rotation that brought fewer large events in June and a loss of high-value midweek room nights, extreme heat with multiple 111°F+ days discouraging casual visitors, and a slowdown in international travel as some travelers chose Europe instead.

Vegas Influencers who use clickbait tactics would only blame this on high fees and nickel and diming, (part of the problem, yes) which is not the entirety of the problem.

Las Vegas Tourism vs. U.S. Summer Travel Trends

National U.S. hotel data from STR shows the country faring better than Las Vegas tourism. In June, U.S. hotel occupancy was 68.5% (-1.7% YoY), ADR was +0.4%, and RevPAR was -1.2%. Las Vegas underperformed these averages, with sharper declines in both demand and room pricing. While cities like New York thrived (occupancy 88.5%), leisure-focused destinations with high summer heat, like Phoenix and Las Vegas, struggled. AAA still projected a record 72.2 million domestic travelers for the July 4 week—but much of that growth came from road trips, budget getaways, and destinations with milder weather.

Europe’s Strong Summer Tourism

While Las Vegas tourism softened, Europe’s most popular cities boomed. The European Travel Commission reports Q1 2025 international arrivals were up 4.9%, with Q2 up 3.3%. Destinations like London, Paris, Rome, and Barcelona saw high demand, with some overtourism issues returning. Even in heat-prone Mediterranean cities, travelers adjusted their timing (opting for June or September) rather than canceling trips entirely. Cooler “northern escape” destinations—like Scandinavia—also gained popularity.

Las Vegas Tourism: The Data

Las Vegas vs. U.S. Hotel Performance (YoY % – Summer 2025) – Las Vegas lagged the U.S. average in all key hotel performance metrics.

Europe International Arrivals Growth (YoY % – 2025) – Europe maintained positive growth in both Q1 and Q2.

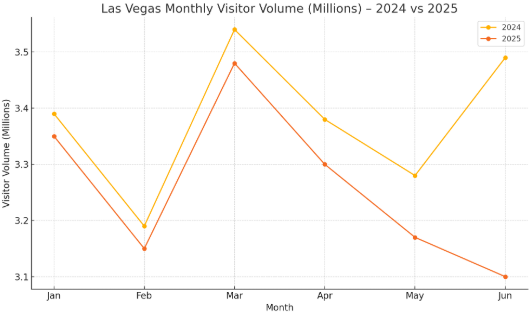

Las Vegas Monthly Visitor Volume (Millions) – 2024 vs. 2025 – Official LVCVA data shows a clear drop in May (-6.5%) and June (-11.3%) 2025 vs. 2024.

The Bottom Line on Las Vegas Tourism

The summer slowdown in Las Vegas tourism comes down to economic caution among travelers, a lighter convention calendar, international visitor declines, excessive heat, and increased competition from European destinations. U.S. travel overall stayed strong but leaned value-focused. Europe remained a powerful draw for summer travelers, leaving Las Vegas to rely heavily on its fall convention season and cooler weather to rebound.

Sources

- Las Vegas Convention and Visitors Authority (LVCVA) – June 2025 Executive Summary

- STR & CoStar – U.S. Hotel Performance Reports, Summer 2025

- AAA – Independence Day Travel Forecast 2025

- European Travel Commission – Tourism Performance Report Q1 & Q2 2025

- National Weather Service – Southwest Heat Alerts Summer 2025

Join the TravelZork FB Group -> HERE

Visit: TravelZork Travel

Stay up to date with: ZorkFest

Also: Watch, Like, and Sub on YouTube

Check it out: The Yo-11 Minutes Playlist on YouTube