Airline Rankings

Each year, I look forward to the Wall Street Journal Airline Rankings. The WSJ has always done a good job of covering the industry, and their quantitatively-based ratings make sense. Plus, they have really cool graphics.

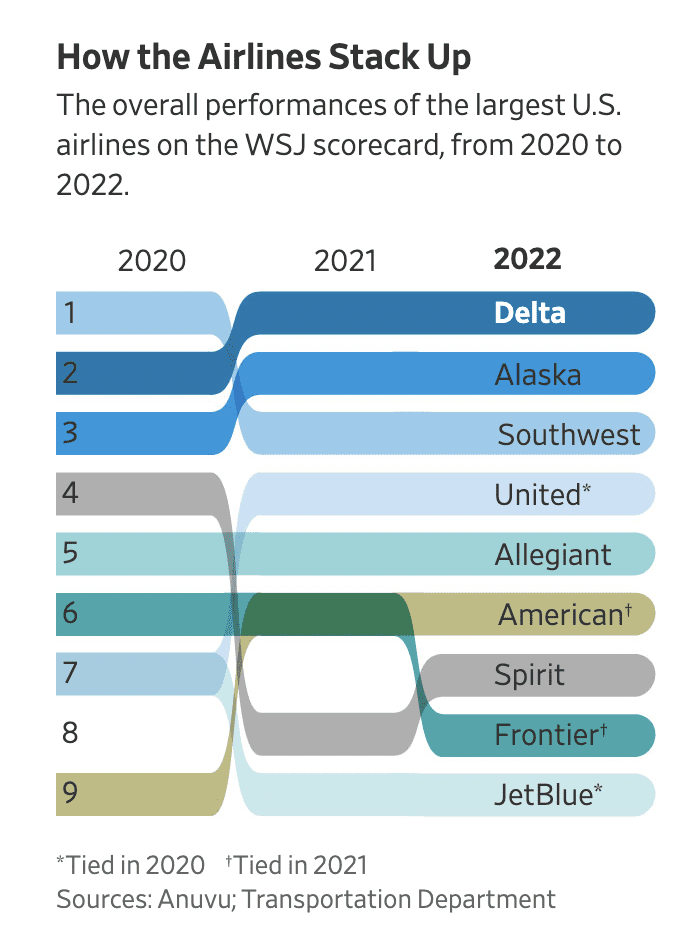

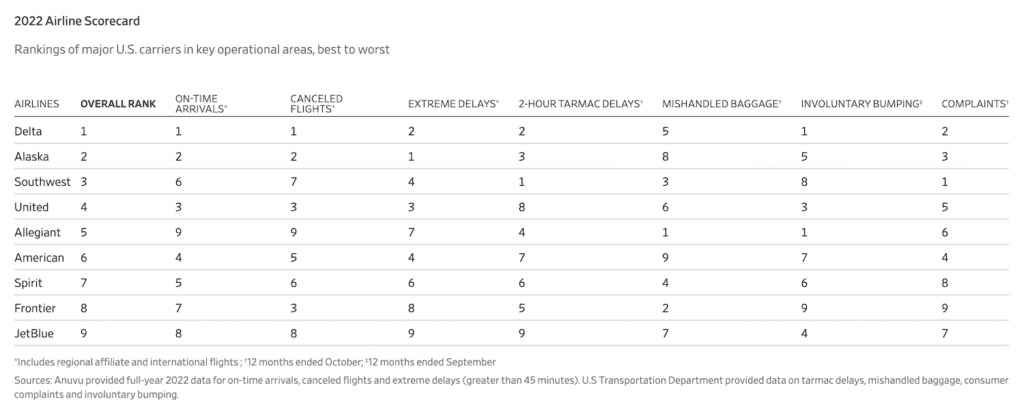

To nobody’s surprise, Delta finished at the top again, with JetBlue at the bottom. Delta has spent the past several years investing in operations and has made a business of simply being a “better” airline. It certainly shows in the airline’s pricing, for both paid tickets and awards. The airline is near the top of the industry in each. But the numbers don’t like: They’re doing a great job.

JetBlue’s Woes

The bigger story, though, may be the continuing decline of JetBlue. Once a leader in customer satisfaction, JetBlue’s operations have declined significantly. It’s not just the summer meltdown, which saw passengers waiting for days after their flights were cancelled. JetBlue’s original model, which was to offer a better product as a discounter, never really panned out. The major carriers easily matched and surpassed JetBlue’s competitive advantage, its in-flight entertainment. Meanwhile, without the high-yielding international traffic, JetBlue struggled to match its peers unit revenues. It’s sad to say that the best thing that the Wall Street Journal Airline rankings could say about JetBlue is that it finished fourth in involuntary denied boardings, considering that the airline claims that it doesn’t overbook flights. Shouldn’t that number be close to zero, accounting for operational issues?

Although its original business model was novel at the time, the airline never evolved with the industry. Arguably, JetBlue’s biggest innovation was its domestic first “Mint” product, but again, a hard product is easily matchable. The plane itself is something that the poll can’t measure.

Other Nuggets from the Wall Street Journal Airline Rankings

- The bottom three performers were all discounters. JetBlue aside, Frontier and Spirit took the other spots at the low end. No surprises there, especially finishing eighth and ninth in complaints. The ultra-low cost carriers (ULCC) are pretty clear about what they offer: a seat. They work fine if nothing goes wrong. But if you have to be there, I’d consider a larger carrier.

- It’s going to get worse at the bottom. Assuming that the JetBlue/Spirit merger comes to fruition, we’ll be left with one major ULCC. They’ll have a lot of power. Not to mention the inevitable hiccups with the integration. Spirit and JetBlue ranked 7th and 9th, respectively, in a nine company field. Together, I expect them to rank 16th.

- Hawaiian gets no love. Alaska Air gets lots. When putting together the Wall Street Journal Airline Rankings, the editors left out Hawaiian. Why? Because they simply have an unfair advantage in a contest where weather plays such a large role. On the other hand, Alaska finished where it normally does: near the top. This year, it was #2. Despite its name, the airline flies to over 100 destinations, not just Alaska. Given how much of their flying is up and down the (relatively) calm west coast, they actually have a geographic advantage. Plus, they run one hell of an operation, and have done so for a couple of decades.

Looking Forward to 2023–It Will Get Tougher

As airlines begin to add capacity back to the sky, it will get more difficult for airlines to maintain their operations. The past three years have seen capacity cuts, allowing the airlines to manage issues such as pilot shortages.

The toughest path ahead will be for Southwest, which starts off at a disadvantage. No doubt they’ll see a number of complaints and denied boardings for the end of the year, some of which will fall into January. As they spend the year improving their technology, there will be some stumbles.

Michael is a travel enthusiast who is passionate about food and casino adventures and is very detail-oriented when it comes to travel, especially when it comes to the entire flight and airport experience. Before returning to the USA, he resided in Europe (Amsterdam and London) from 2013 to 2020. Current passion projects include TravelZork, the creation of ZorkFest (The Preeminent Consumer-Focused Travel Loyalty (Miles+Points) and Casino Loyalty Conference), and ZorkCast Podcast. In addition, Michael is passionate about the history of Las Vegas and Atlantic City, as well as baccarat, and enjoys cooking and experiencing food around the globe.