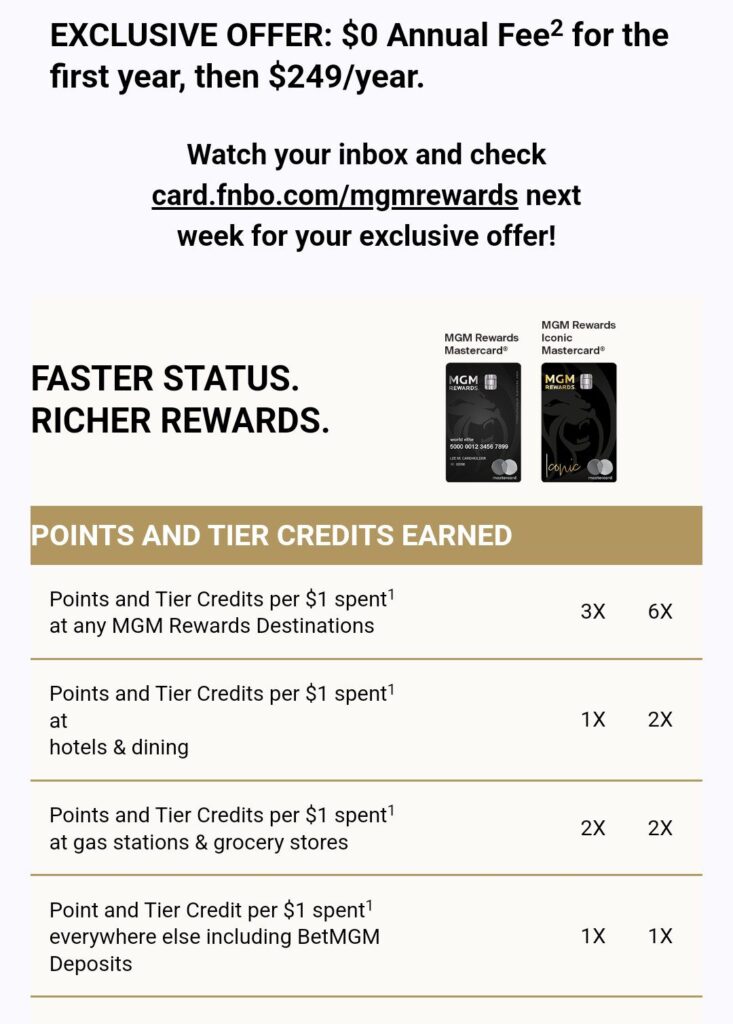

After teasing a new premium credit card in a recent press release, MGM Rewards delivered on its promise with the MGM Rewards Iconic credit card, a new credit card offering incredible potential for status and comp earnings, especially for gamblers who can use the card to fund and play on BetMGM.

In the past, I wrote an article about why I place tremendous value on the no annual fee MGM Mastercard, mainly because of the ability to spend towards MGM Gold and Platinum status which offer waived resort fees, comp cruises (now, two total with Gold and Platinum) bonus comp credits, room upgrades, and late checkout times.

The Iconic card, in addition to the no annual fee MGM Mastercard, makes it even easier to earn higher levels of status and more rewards with MGM, thanks to increased spending power, particularly on BetMGM deposits.

The Iconic card also offers 6x tier and comps or freeplay on spending at MGM casinos, a $200 ‘resort credit’ per card anniversary year ($200 in comps or 20,000 MGM Rewards Points, even on comp nights booked through MyVegas), a $250 rebate and bonus 10,000 tier credits per anniversary year after $25,000 card spend ($250 in comps, also applying on MyVegas comp nights), and other probably not-so-notable benefits including Global Entry reimbursements.

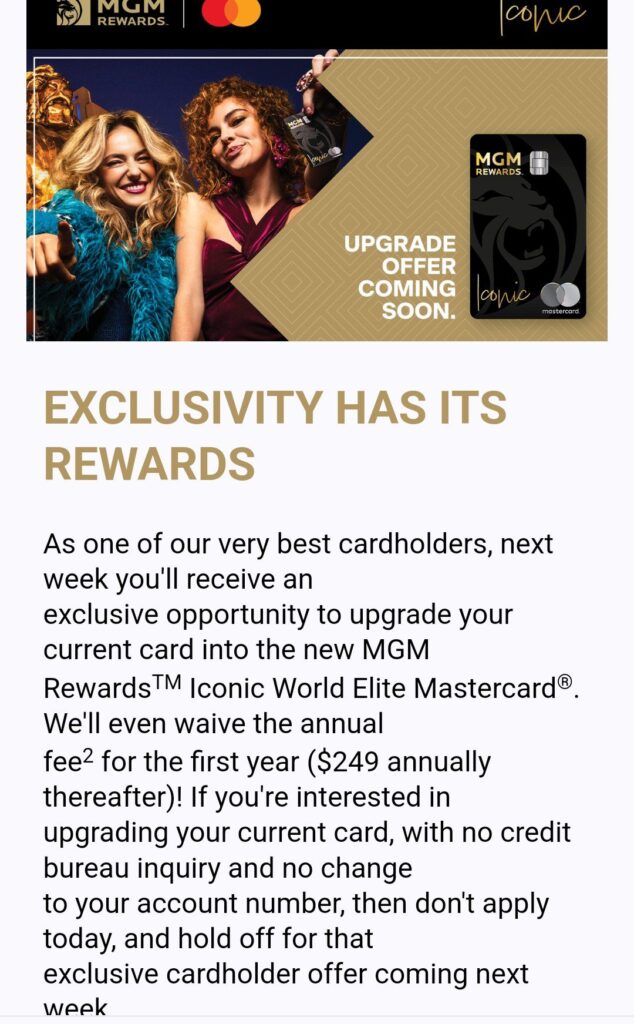

The new Iconic card has a $249 annual fee, but this is easily offset by a 40,000 MGM Rewards Points welcome bonus and the easily achievable $450 worth of credits from the various benefits. Existing no annual fee cardholders are also receiving e-mails mentioning soon-to-come upgrade offers, including a waived annual fee in year one, but it might be best to decline the upgrade offer to have both the no annual fee and annual fee card for more spending power and the 40,000 point welcome bonus.

The Fine Print

MGM fine print states that cardholders may only receive a credit card welcome bonus on any card once per 12 months, so cardholders relatively new to the no annual fee MGM Mastercard may choose to upgrade for a year of benefits with no annual fee, then apply for the no annual fee card 12 months later for more spending power.

Is It For You?

Those who don’t live in online gambling states will likely still find value in both MGM credit cards because they can travel to states like PA, NJ, and MI to play Blackjack giving up about a half percent house edge with optimal basic strategy play in games like Multi-hand Blackjack Surrender, but earning at least 1x in comps and tier and, on the Iconic credit card, spending towards the $25,000 spending goal for more rewards.

For people living outside online gambling sites, especially during promotions offering 3x tier and comps or freeplay on BetMGM loads, it’s hard to argue against a short trip to somewhere near MGM Grand Detroit, Atlantic City, or Philadelphia, combining other travels (possibly including in-person casino play) with online gambling using MGM credit cards to fund BetMGM. One can even more effectively utilize an airport layover or stopover for BetMGM play.

I look forward to applying for the new MGM Rewards Iconic credit card, adding it to my existing no annual fee MGM Mastercard. This will be one of the easiest credit card decisions of the year for me, and hopefully you, too, especially if you live in PA, NJ, or MI or will travel for BetMGM play combined with other travel activities. Iconic, indeed!