Problem :

You want to get those 100,000 points for a new credit card sign-up but the sign-up requires significant credit card spend in a “short” period of time. For example, the Enhanced Business Platinum® Card promotion or the expired Chase Sapphire Reserve deal.

Solution :

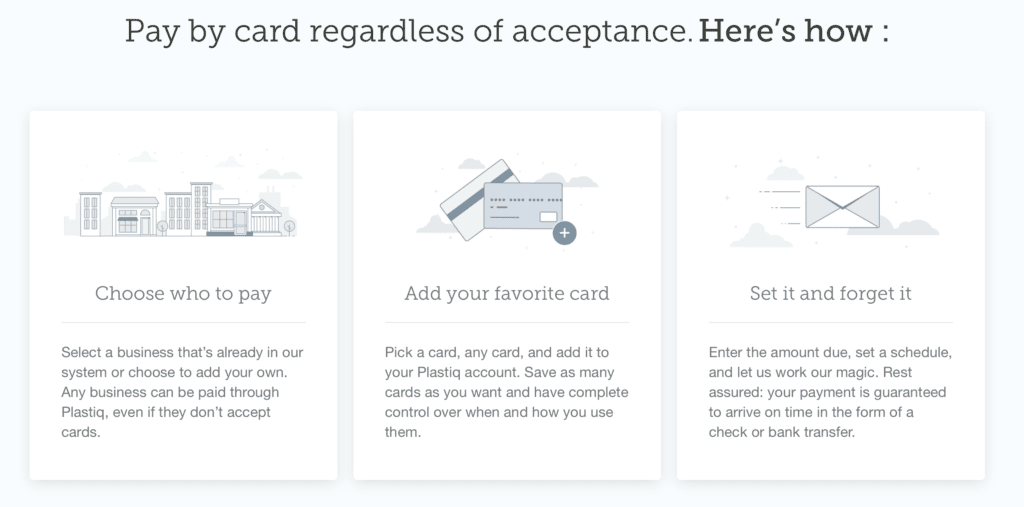

For a fee, use your credit card to pay bills that you regularly pay using cash, check or debit card.

Plastiq Payment System is a unique bill payment service that allows you to pay almost any bill using a credit card for a fee that does not exceed 2.5%. The options for payment are extensive and include many popular payment categories :

Tuition

Utilities (Electric, Water, Gas, Solar or Internet)

Auto Loans

Rent or Mortgage

HOA

Insurance

Taxes

Country Club

Contractors

Cellphone

and more!!!

Why Sign Up for a Credit Card Promotion?

These outlier promotions that award an extreme amount of points, for example 100,000 Membership Reward Points, have an huge value if used properly for premium travel. One example, 62,500 AMEX Membership Rewards can be transferred to FlyingBlue for an award ticket in business class to Europe. This is just one of many options. Is it always easy to find award availability? No. But, a “free” 100,000 points is still a “free” 100,000 points even if that requires a 2.5% surcharge to meet your spend requirement to get the bonus points.

What are the points worth? Currencies like Membership rewards are valued modestly at 1cent per point up to 2cents per point (100k = $1000 to $2000) but can sometimes be used to redeem awards up to 4-5cents per point. Yes, it’s best to achieve the spend without using a service like Plastiq, but that is often impossible for those that do not have large day to day or monthly credit card spend/purchases.

Other Benefits or Uses – Pay Rent with a Credit Card

Even if not an outlier promotion, like the ones discussed above, you sometimes need to achieve spend on a specific credit card to get a “waiver.” Delta allows one to receive a Delta spend waiver (MQD, Medallion Qualification Dollar waiver) by spending $25,000 per year on a qualifying Delta AMEX product.

Just the simple act of paying your rent automatically on a monthly basis using Plastiq Payment System can make reaching that $25,000 yearly goal a bit less stressful. These scenarios are becoming more prevalent as loyalty programs for airlines focus on your yearly spend as well as miles and segments flown.

Every year, the miles & points “game” becomes a little bit harder. Services like Plastiq represent a potential solution at a relatively low cost when you consider the potential benefits.

Michael is a travel enthusiast who is passionate about food and casino adventures and is very detail-oriented when it comes to travel, especially when it comes to the entire flight and airport experience. Before returning to the USA, he resided in Europe (Amsterdam and London) from 2013 to 2020. Current passion projects include TravelZork, the creation of ZorkFest (The Preeminent Consumer-Focused Travel Loyalty (Miles+Points) and Casino Loyalty Conference), and ZorkCast Podcast. In addition, Michael is passionate about the history of Las Vegas and Atlantic City, as well as baccarat, and enjoys cooking and experiencing food around the globe.