Southwest Airlines | Points Learning from Scratch

Most people know about the Miles and Points world, but many think it’s too complicated or time consuming to enter. It doesn’t have to be. You’ve got to start somewhere with any endeavor that is worthwhile. A family member mentioned that they’d like to plan a surprise family trip to a beach resort in Florida and I offered to do the Miles and Points research to help them out. I’m going to detail the process in this series of articles.

One of the main ways you work Miles and Points is by signing up for travel credit cards that have big bonuses, valuable earn rates and promotions for charging to the card. The goal is to use your spending power or Spend (the money you would use to purchase goods or services in daily life anyway) to get the most value per dollar spent, for the travel products that best fit your plans.

On this trip, there will be a family of four going from the Philadelphia area to Florida and they can easily fly out of Philadelphia International Airport or Newark International Airport and thus, can avail themselves of one of the most valuable airline perks out there—the Southwest Airlines Companion Pass.

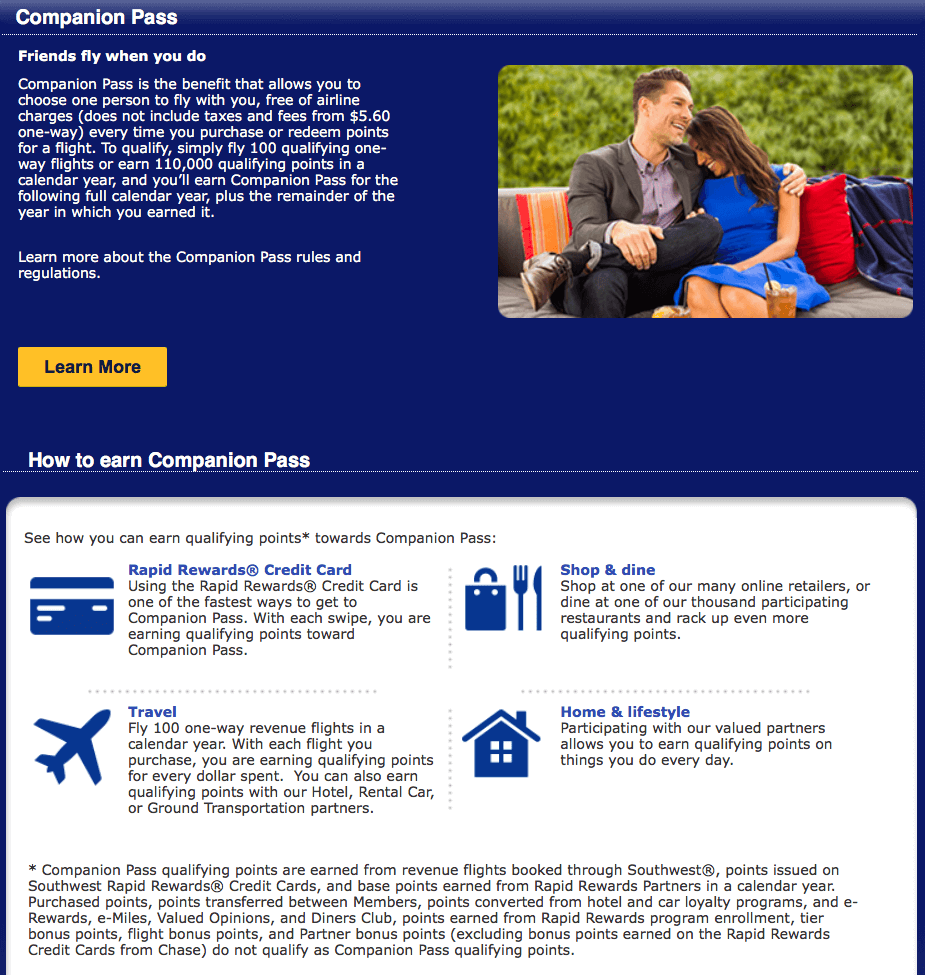

Southwest Companion Pass – Fantastic Deal

The Southwest Companion Pass is a fantastic deal, because you can earn the necessary 110,000 qualifying points with credit card bonuses and the bonus offers for the two personal Chase Southwest credit cards have just gone from 40,000 Rapid Rewards points to 50,000 Rapid Rewards points. [Please visit Miles to Memories, for the 50k point offer and to learn more about the Southwest Credit Card options.] If you also apply for and receive the Southwest Premier Business credit card, which offers 60,000 points, you can earn the Companion Pass for the rest of 2018 and all of 2019.

The Companion Pass allows you to choose one person to fly with you, free of charge (except for taxes and fees from $5.60 each way) every time you purchase or redeem points for a flight and you can change the designated companion up to three times per calendar year.

After my family member applies and gets approved for both credit cards and spends the required amount on the cards to trigger the bonuses, she will have 110,000 Rapid Reward points, plus at least 2000 plus 3000 points from the spend requirements on the two credit cards, plus the Companion Pass. That will be more than enough for four round trip flights to Florida and if low flight prices are stalked, those points could be stretched out for years!

Related: Finding Low Fares on Southwest Airlines

Now, these benefits aren’t completely free, but the costs will be only a fraction of the amount needed to pay outright. There is a yearly fee for all three of the Chase credit cards and there may be additional fees to charge big bills, such as a mortgage, car payment, etc. to meet the spend requirements.

Effort must be expended to apply for the cards, manage them and keep on top of any additional promotions on the cards to add extra value, but once you get familiar with how Miles and Points work generally, the work becomes minimal, unless you want to step up your game.

The next step will be deciding exactly where in Florida the trip is going to be and then researching resorts and which hotel loyalty programs and credit cards will pay the biggest portion towards lodging. Isn’t this fun? You’ve got to do some research to book any trip, so why not look into ways to make it less expensive and possibly have enough money to go on extra vacations!

Catherine gravitates towards any activity that has to do with planning and lists.

This has served her well while trying to play optimally in casinos for over 10 years and traveling on a budget and working frequent flyer deals for over 30 years. Catherine’s affinity for tiny calendar stickers transformed into a love affair with the super cute world of Hello Kitty, which has been ongoing for more than 40 years!