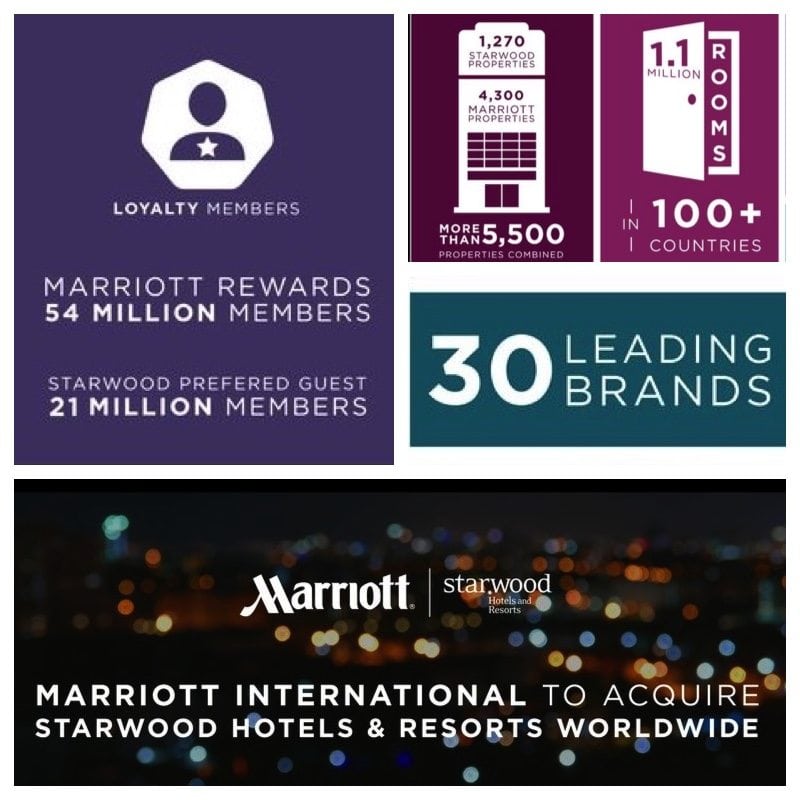

By now, you have probably heard the big news in the hotel and hotel loyalty world : “Marriott International to Acquire Starwood Hotels & Resorts Worldwide, Creating the World’s Largest Hotel Company.” (press release HERE)

By now, you have probably heard the big news in the hotel and hotel loyalty world : “Marriott International to Acquire Starwood Hotels & Resorts Worldwide, Creating the World’s Largest Hotel Company.” (press release HERE)

Our immediate attention turns to the loyalty programs of Marriott Rewards and Starwood Preferred Guest (SPG). According to the press release “Leading Loyalty Programs: Today, Marriott Rewards, with 54 million members, and Starwood Preferred Guest, with 21 million members, are among the industry’s most-awarded loyalty programs, driving significant repeat business. They should be even stronger when the companies merge.” This leads us to a generalized view that the two programs will be merged sometime in the future, most likely in 2016 to coincide with the transaction.

In the hotel loyalty community (see Mike Friedman’s article at InsideFlyer) many value SPG points as some of the most valuable currency in the industry. There is also a very strong feeling among SPG members, that the elite benefits for the SPG program exceed what is offered my Marriott Rewards. Features like transferability of SPG points to airline miles at a competitive rate with bonuses and confirmed suite upgrades are some of the highlights of the Starwood loyalty program. In addition, obtaining top tier (Starwood Platinum Preferred Guest) is in many ways easier than top tier with Marriott (Marriott Rewards Platinum Elite).

Details like the Starwood Delta SkyMiles relationship and Marriott United MileagePlus relationship will be interesting elements of the acquisition that shall become a bit more transparent over the next few months.

In our TravelZork feature Potential Hotel Chain Merger Would Have Major Impact In Las Vegas, earlier this month we surmised about the possibility of Hyatt Hotels acquiring Starwood Hotels. We discussed Marriott’s sole hotel partner on the Vegas strip, The Cosmopolitan of Las Vegas. In addition, we mentioned the prospect of Marriott becoming a “free agent,” if Cosmopolitan left the Marriott relationship.

Now, with the pending merger of Marriott International and Starwood, the Starwood relationship with Caesars Total Rewards becomes a very interesting scenario. Also, when you take into account the recent moves in Las Vegas for Starwood with regard to SLS becoming part of Starwood Tribute Portfolio and the opening of the much anticipated W Las Vegas resort, Marriott jumps from a minor player in Las Vegas to potentially one of the biggest players. In essence, after the merger the new Marriott/Starwood is poised to have a prominent position in both the hotel and loyalty market in Las Vegas.

While the prospects for Cosmopolitan are quite unknown, it would be unusual for Marriott/Starwood to retain a separate loyalty program for Cosmopolitan (Identity) when Starwood already has such a strong alliance with Caesars Entertainment and Total Rewards. From a competitive point of view and considering that the vast majority of the Las Vegas strip from a loyalty perspective is controlled by Mlife and Total Rewards it is never a good prospect to be losing a loyalty program.

If I had my choice, I would love to see Caesars Entertainment sell some of their underperforming Las Vegas hotels to a strong independent operator. Unfortunately, there seem to be few viable options at the moment. In addition, while Hyatt is in a strong market position with MGM (Mlife) in Las Vegas they are now in a much less enviable position globally competing against the eventual 30 brands and 5,500 properties of the future Marriott/SPG hotel organization. Not to mention, a combined 75 million loyalty members in a merged program.

This should be very interesting, indeed, or both Las Vegas casino loyalty and the global state of hotel loyalty programs.

Be sure to also check out additional Vegas commentary from EdgeVegas, and hotel loyalty commentary from InsideFlyer.

Michael is a travel enthusiast who is passionate about food and casino adventures and is very detail-oriented when it comes to travel, especially when it comes to the entire flight and airport experience. Before returning to the USA, he resided in Europe (Amsterdam and London) from 2013 to 2020. Current passion projects include TravelZork, the creation of ZorkFest (The Preeminent Consumer-Focused Travel Loyalty (Miles+Points) and Casino Loyalty Conference), and ZorkCast Podcast. In addition, Michael is passionate about the history of Las Vegas and Atlantic City, as well as baccarat, and enjoys cooking and experiencing food around the globe.