I try not to spend too much time focusing on credit cards, since there are plenty of sites for those. But the fact remains that credit card sign-up bonuses are one of the best ways to earn big points fast. They’re also one of the simplest. Right now, I’d recommend looking at two Chase credit cards: Chase Sapphire Preferred and Chase Business Ink Unlimited. The latter comes with a best-ever bonus.

Affiliate Disclosure: To answer your first question, yes, some of these links do pay us referral fees. But please keep two things in mind: First, we will never post a card simply because of the opportunity to earn money. In fact, we own most of the cards personally that show up on the “our favorite cards” page. And second, if we see a better offer for the same card that we can give you, we will direct you to it. We promise. The content on this page is all ours. The companies that we discuss do not review or endorse it. All opinions are ours. You can’t have them. Please view our advertising disclosure page for additional details about our partners.

What Can You Get from Chase Sign-Up Bonuses?

Credit card sign up bonuses are a great source of either points or cash.

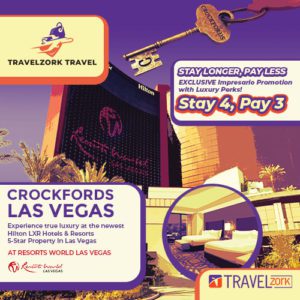

What about 3-4 nights at a luxury hotel? In Las Vegas, that would include properties such as Bellagio, Aria and Delano. I’ll show you how below!

Chase Sapphire Preferred

The Chase Sapphire Preferred card offers 60,000 Chase Ultimate Reward (UR) points when you spend $4,000 in the first three months. The card carries a $95 annual fee, which is a fraction of the bonus to get it. So what are the best uses of your points?

- Points transfer at the rate of a penny each, so your 60,000 UR points are worth $600.

- Get a 25% bonus if you use them to confirm travel through Chase. That’s $750 worth of travel!

- Possibly the best use: Transfer them to one of 11 airline partners or 3 hotel partners. Airline points tend to be more valuable, but hotels can work well, too. Since Hyatt is one of those partners, you can book MGM properties in Las Vegas with these points. Bellagio, Delano and Aria start at 21,000 points each. Want something a bit simpler? Excalibur starts at 9,000 points per night!

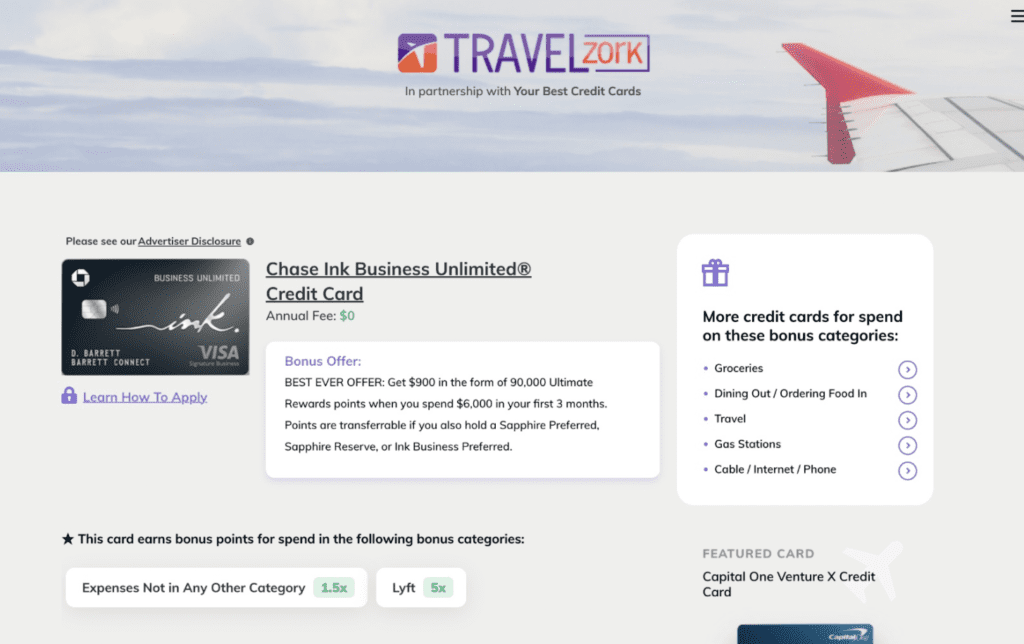

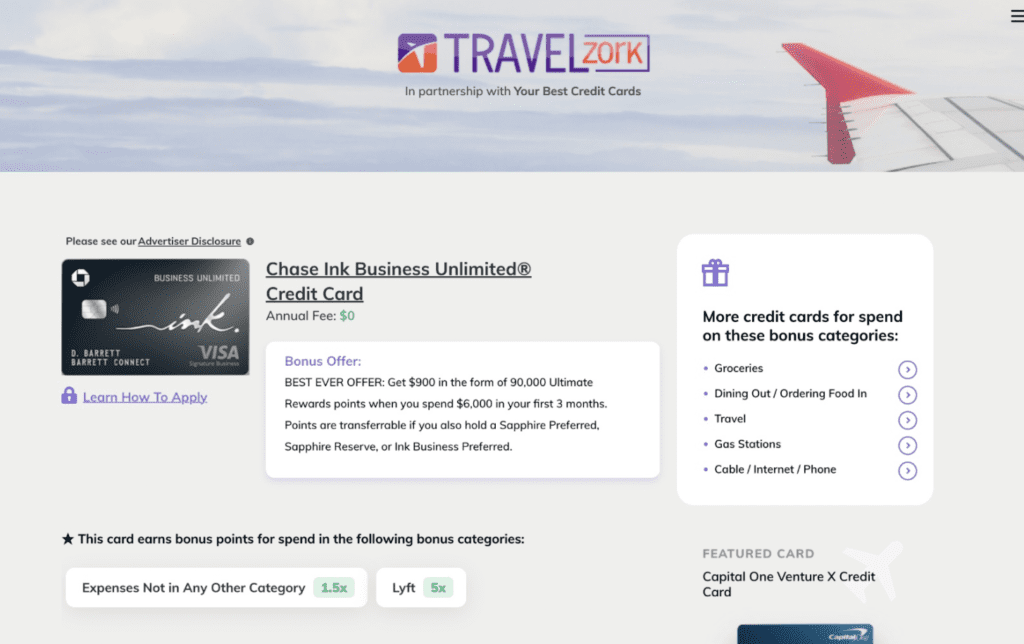

Chase Ink Business Unlimited

A business card? It might sound intimidating, but you don’t have to have millions in revenue to be eligible. Do you run a side hustle? A blog? Something else? You may be eligible and not know it.

The Chase Ink Business Unlimited card is offering its best sign-up bonus ever: 90,000 point sign up bonus when you spend $6,000 in the first three months. That’s $900 in value or 90,000 points* to transfer to an airline or hotel partner. Including the initial spending, that’s almost 5 nights at a luxury Las Vegas property! Or just keep the cash and blow it at the slots. There is no annual fee.

*Important: Unlike the Chase Sapphire Preferred, Chase Ink Business Unlimited points cannot be transferred to airline partners, unless you also have a qualifying card, such as the Chase Sapphire Preferred, Chase Sapphire Reserve or Chase Ink Business Preferred. Even if you don’t transfer them to a partner, $900 in cash is still a pretty good haul.

Additional Benefits for the Cards

These two Chase credit cards have great benefits for ongoing use. One benefit that comes with both cards, though, is primary rental card insurance. When using the Sapphire Preferred card or Ink Business Unlimited to pay for your rental car, you can waive collision and theft insurance. In other words, if you’re in an accident, your auto insurance company won’t have to be involved. Note: You’ll still need liability and the Ink card only provides primary coverage for business rentals.

Chase Sapphire Preferred

- 5X points for Airfare, Car rentals, Hotels, Lyft and other travel booked through the Chase travel portal

- 3X points for dining and streaming services

- 2X points on travel booked directly with a travel provider

- 1X points on all other purchase

- An annual $50 hotel credit

- A 10% anniversary bonus. Each year, on your card anniversary, you’ll earn a bonus equal to 10% of your previous year spending.

Chase Ink Business Unlimited

- 1.5X points on all purchases. Easy to remember and these points can be exchanged for airline or hotel points, which are worth more than a penny each!

- 5X points on Lyft.

- Like the Sapphire preferred, there is no limit to the amount of points that you can earn

Ultimate Rewards Transfer Partners — Chase Sapphire Preferred

The best use of points is to transfer them to an airline. Roundtrip domestic tickets in first class, or global business class tickets are all within reach if you’re starting off with over 90,000 points. Partners such as Singapore, Emirates and British Airways can get you almost anywhere you need to go.

Most Chase credit cards offer rewards in Chase Ultimate Rewards points. These points can be exchanged for cash (at a rate of 1 – 1.25 cents per point, depending on what you are buying). They can also be exchanged for miles at 11 airline or 3 hotel partners. They include:

- Aer Lingus AerClub

- Air Canada Aeroplan

- British Airways Executive Club

- Emirates Skywards

- Air France/KLM Flying Blue

- Iberia Plus

- JetBlue True Blue

- Singapore Airlines Kris Flyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying club

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

The Bottom Line for your Bottom Line — Don’t Pay Interest

Chase credit cards offer some great sign up bonuses as well as ongoing benefits. But don’t forget how they make their money. If you don’t pay your balance in full every month, the card company will charge extremely high interest rates. Your annual percentage rate could be 20% or more. The bottom line: There’s no rewards card that even comes close to the interest they charge. If you don’t pay your balances in full every month, get a low interest rate card.