Delta Delays Capacity Growth & Jet Delivery To Improve Key Financial Metrics

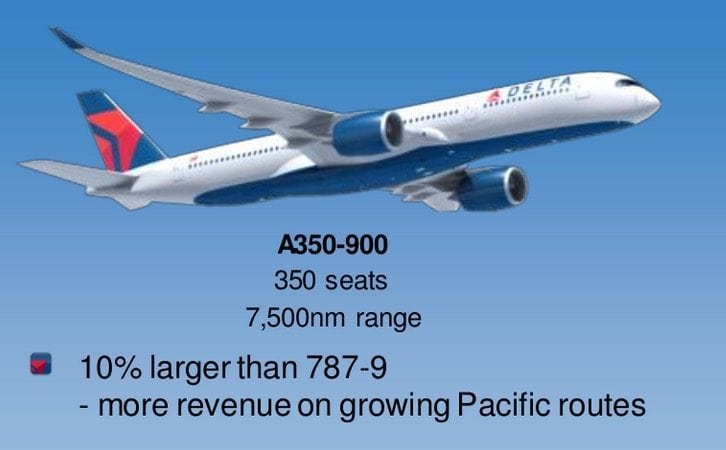

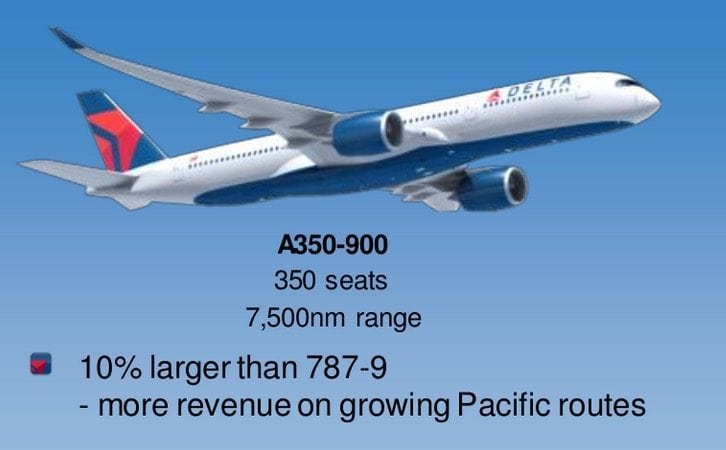

Bloomberg just published an article announcing that Delta will be trimming their previously announced growth plans and delaying the delivery of four Airbus A350 aircraft. The reason? As a publicly traded company Delta (NYSE:DAL) has a fiduciary responsibility to its shareholders to provide growth through the price of its stock and income in the form of dividends. And they have been doing a monster job in both areas for the last several years.

In 2008-2009 the collapse of Bear Stearns, Lehman Brothers and the entire housing / mortgage / loan industry took the US economy to its knees. Having just come back from a Chapter 11 bankruptcy that lasted from 2005 to 2007 and alienated many of its loyal customers, Delta stock hit a low of $4.08 per share in March of 2009. Since that time, it has returned a stunning 11X gain with DAL stock trading at $44 as of this writing. In addition to that capital gain DAL stock pays a dividend to their shareholders of $.54 per share which is a Forward Annual Dividend Yield of 1.3%. Earlier this year DAL announced that they will increase that dividend by 50% to $.81 per share, taking the dividend yield up closer to 2%. That’s not stellar, but in an era of 0.01% yields at your local Wells Fargo or Bank America branch, it’s a decent return for the risk you take owning the stock. Let’s put that into perspective. If you had $1,000,000 burning a hole in your pocket because you got 2% cash back on your recent purchase of a personal jet for $50,000,000, your bank would be thrilled if you deposited it into a savings account. They’d be so thrilled they would give you ~$83 in interest every month. Whoa there Warren Buffet, don’t get too excited.

Delta Changes Track

So what is the significance of the Delta announcement? Since Delta’s ultimate responsibility is to its shareholders, it is rewarded (or punished) based upon how well it performs against the key financial metrics that are tracked by the Wall Street analysts. The metric that has the executives at Delta headquarters in Atlanta most concerned right now is Passenger Revenue Per Available Seat Mile (PRPASM). Unlike a lot of mind numbing financial metrics like Diluted Earnings Per Share TTM (Trailing Twelve Months), Book Value Per Share and Enterprise Value, this one, PRPASM, is pretty easy to wrap your head around. Basically, you take the number of seats you have on all of your airplanes that are in service, multiply it by the number of flights that they fly and divide it into the amount of money you make, and there you have it. (The true calculations are more complex, but the principle is the same). Despite all of its success over the last 9 years, Delta has seen this key metric suffer. Bloomberg published the following graph to illustrate this trend.

On a year over year basis Delta has seen Passenger Revenue Per Available Seat Mile shrink by somewhere in the 1-5% range in each of the last five fiscal quarters. If a trend like that continues, it’s not a good sign for Delta’s financial performance. Cost cutting measures can only do so much. In theory you can only drive costs to $0, but there is no limit on the amount of revenue you can generate if the demand in the market exists. As a major global airline, Delta is also subject to fluctuations in the value of major currencies. They can hedge against this by buying or selling currency futures, but there is some risk in that approach if the currency moves in opposition to the hedged position. For Delta, the biggest factor from a currency perspective is that the Euro has fallen 17% against the dollar in the past two years. With 20% of their capacity dedicated to serving Europe, the fall in the Euro has kept fares low, but also had a negative effect on PRPASM.

Running an airline, a major airline like Delta, is a herculean task. It’s a capital intensive business; airplanes, facilities and parts cost a fortune, it relies heavily on the price of a somewhat wildly fluctuating commodity, oil, and it has tens of thousands of employees that need to be motivated and fairly compensated for their work. Delta has done amazing work with all of these factors, buying more fuel-efficient aircraft at the very best price, hedging against the fluctuations in the price of oil and even buying their own refinery to control more of the jet fuel supply chain, and incentivizing their employees by offering profit sharing that has paid off generously for the team at Delta.

So back to the announced cuts in aircraft deliveries and future growth. To increase that PRPASM metric Delta can do a few things. The first is they can raise prices. I don’t think that’s going to work right now. CNN/Money published an article in late April stating that US domestic airfares had dropped to a low of $363 on average. That’s an annual drop of 8.3% and the lowest fares have been since 2010. It’s a little bit of a chore to accurately fact check these numbers because the airlines keep coming up with new fees to tack on that aren’t calculated into the “fare” that is being measured:

“Hey SteveHacksTravel would you like to pay the “keep your seat” fee of $25 that ensures we won’t take the seat you selected away and sit you in between a screaming baby with 7 teeth pushing through their gums and the guy who insists on telling you the story of their latest hernia operation?”

The love/hate relationship US travelers have with ultra low cost carriers like Spirit and Allegiant has driven the major airlines to introduce Basic Economy fares that come without niceties like full credit for frequent flyer miles and pre-assigned seating. Bottom line: Increasing fares isn’t going to work in the short term.

So, what Delta is doing, by announcing these two changes, is probably the very best choice. By putting off the delivery of those four Airbus A350 aircraft they postpone the addition of 1400 seats and the capital cost of acquiring or leasing the aircraft. They could possibly net out the seat additions by retiring other less fuel efficient aircraft but the A350 is really a plane for major routes and Delta already has aggressive plans in place to get rid of the big fuel-drinkers in the near future, so that’s already factored into their plans.

By ratcheting back on growth via route expansion or by tapering the number of flights to a given destination, Delta is putting less seats in play, effectively lowering the number of Available Seat Miles that factor into the bigger calculation. That should yield a better PRPASM metric if all other things remain fairly constant.

What does this all mean to us as Delta customers?

Truthfully, not a whole lot unless you were counting on a route that won’t be started or had your sights set on flying a Delta A350 in the very near future. We’re much more concerned about things like SkyMiles, upgrades, award tickets, pre-departure beverages and whether there’s enough Woodford in the bar to make it all the way to our destination. As interesting and lively as it is in the world of flying frequently, we’ve got to have a financially stable and thriving airline to do it on. Delta is working hard to make sure that’s the case.